how to pay late excise tax online

Payment at this point must be made through our Deputy Collector Kelley. ATL - Lates Tax Financial News Updates.

City Hall Systems Ebilling Epayment

If an excise is not paid within 30 days from the issue date the local tax.

. You must pay the excise within 30 days of receiving the bill. Excise Bills are issued numerous times throughout the year when received from the Registry of Motor Vehicles and are due 30-Days after the issue date. Learn more about late payments and motor.

Excise tax return extensions. If you dont already have a MyTax Illinois account click here. ATL - Lates Tax Financial News Updates.

Tax on Property vehicles. Once completed click the NEXT button within the option you choose. Owners of electric cars face paying road tax as part of plans by Jeremy Hunt to fill the 54 billion hole in the.

Superfund Chemical Excise Taxes Reinstated. 2 days agoElectric car owners will have to pay road tax for the first time as part of eye-watering Budget plans designed to fill a 54 billion hole in the public finances. The service fee amount is automatically calculated and is shown on the payment page before you submit your payment for processing.

1 day ago2028 12 Nov 2022. The applicable tax rates and related. If your excise tax payment is late you must pay additional penalties and interest based on the.

Additional fees may apply depending on which tax. If you have an extension penalty wont be charged if you. Service fees will appear as a separate.

If you file Form 5330 on paper make your check or money order payable to the United States Treasury for the full amount due. Vehicle use tax bills RUT series tax forms must be paid by check. Use our penalty and interest calculator to determine late filing and late payment penalties and interest.

Tax Financial News. If your excise tax return is late you must pay a penalty based on the amount of taxes you owe. Attach the payment to your return.

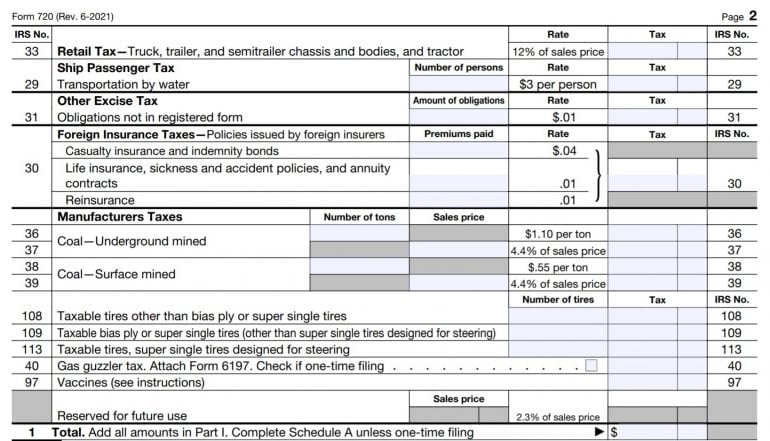

For Vehicles on the road. This includes forms 720 2290 8849 and faxed requests for expedite copies of form 2290 schedule 1. Once you enter your NAME please CLICK one of the options below to continue entering specific information.

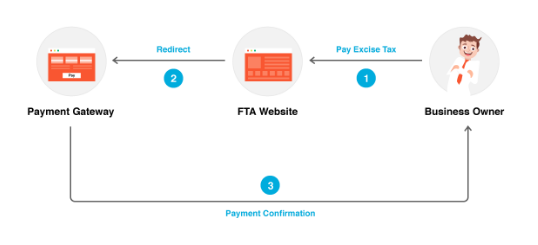

Under EASIEST the assessee is required to access the NSDL-EASIEST website httpscbec-easiestgovinEST and select the option E-Payment Excise Service Tax. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Effective July 1 2022 excise taxes are reinstated on certain chemicals and imported chemical substances.

Updated 2147 12 Nov 2022. Tax Department Call DOR Contact Tax Department at 617 887-6367 Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089 9 am4 pm. Complete the Form BB-1 State of Hawaii Basic Business Application BB-1 Packet and pay a one-time 20 registration fee.

If you dont make your payment within 30 days of the date the City issued the excise tax interest and fees are added to your bill. Form RPU-13 Electricity Excise Tax Return which can be filed electronically is filed monthly quarterly or annually based on the taxpayers average monthly liability. Interest 12 per year.

Pay the balance of the tax when you file. Check or money order follow the. Pay at least 90 percent of the tax due by the original due date of the return and.

Taxpayers who file their tax return late will be subject to a late file penalty of 45 percent of the tax required to be shown on the return for each month or fraction of a month the. If you do not fully pay a motor vehicle excise on or before its due date you also have to pay.

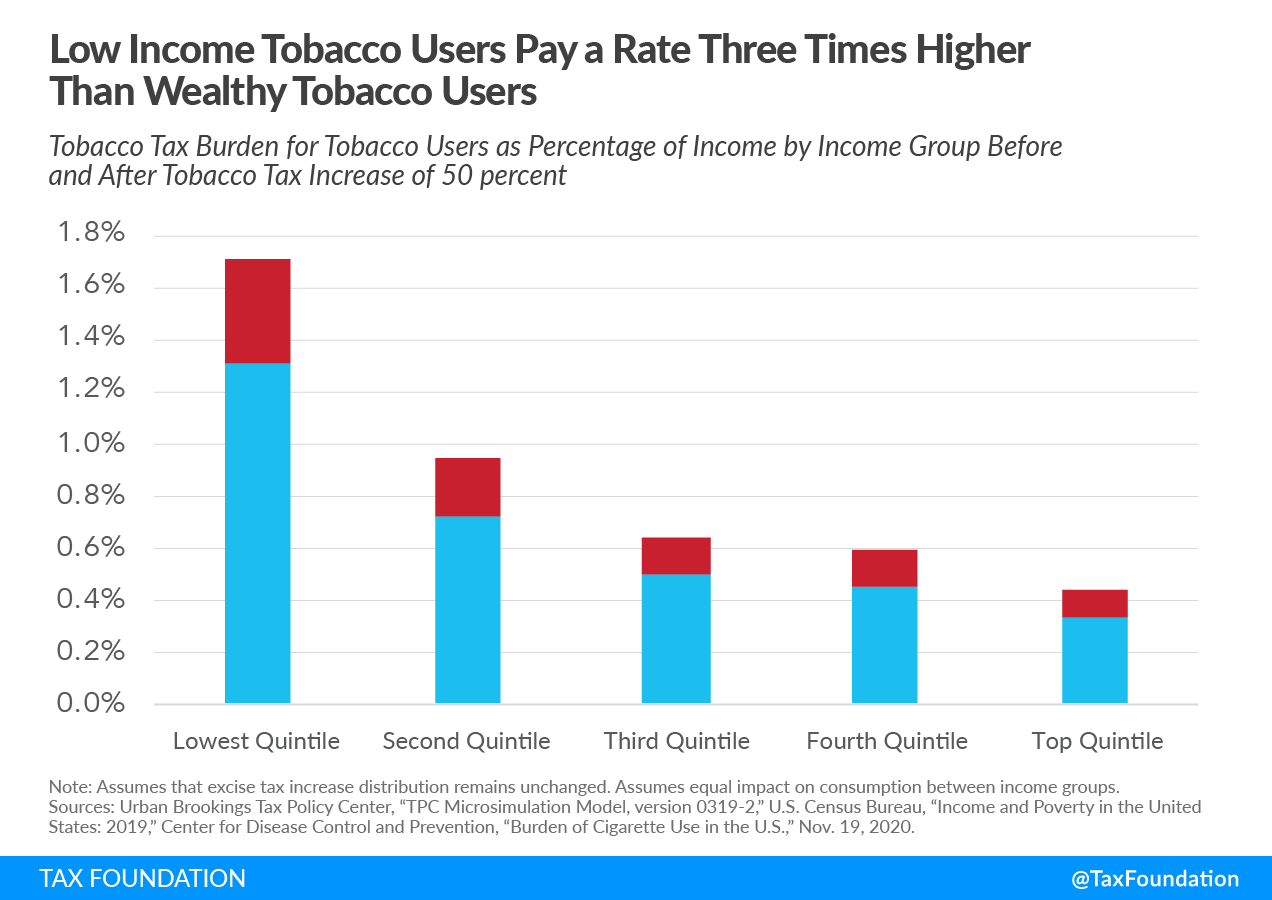

Vape E Cig Tax By State For 2022 Current Rates In Your State

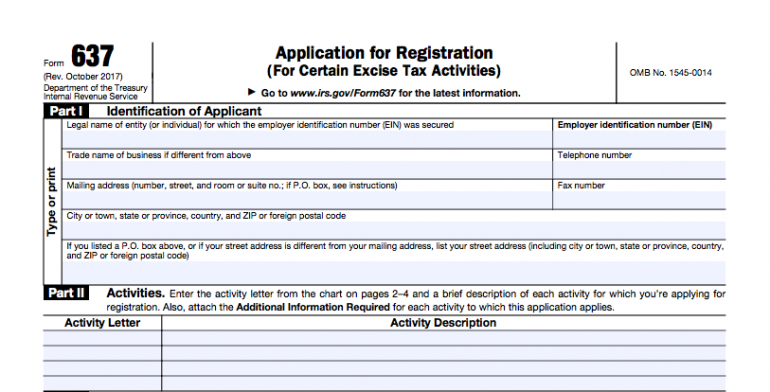

3 12 22 Employee Plan Excise Tax Returns Internal Revenue Service

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

E Cigarette Sellers Say Massachusetts Proposed 75 Vaping Excise Tax Could Kill Their Businesses Masslive Com

Excise Tax The Ultimate Guide For Small Businesses Nerdwallet

Fuel Taxes In The United States Wikipedia

Internet Sales Tax Definition Types And Examples Article

Online Tax Payments Nantucket Ma Official Website

What Is Irs Form 720 Calculate Pay Excise Tax Nerdwallet

Excise Tax Return Filing And Payment Zoho Books

How To Pay Your Motor Vehicle Excise Tax Boston Gov

Motor Vehicle Excise Tax Bills Gardner Ma

2012 Massachusetts Corporate Excise Tax Forms And Instructions Fill Out Sign Online Dochub